Chief Economist, Bright MLS

Rapid home price appreciation and elevated mortgage rates have made it increasingly difficult for families to afford to buy a home. Recent data has shown that it is more affordable to rent than to buy in every large metropolitan area across the country. The income needed to afford a typical starter home in the U.S. has surged over the past four years. While it has gotten harder, there are bright spots where starter homes are more plentiful.

How much do you need to earn to afford a “starter home” in each metro area?

Home prices vary considerably by metro area and the income needed to afford a starter home also varies—from a low of $33,200 in Toledo, Ohio, to a high of $362,600 in San Jose, California. (A starter home is defined as a single-family home priced at the 25th percentile of the market.)

But salaries are also different depending on where you live and work. The median household income in the U.S. is about $75,000. A household earning $75,000 could be a family in Boise, Idaho with one adult working as a retail salesperson and one adult working as a firefighter. Or a single graphic designer in Boston, Massachusetts. Or a legal secretary and a pharmacy tech working in Baton Rouge, Louisiana.

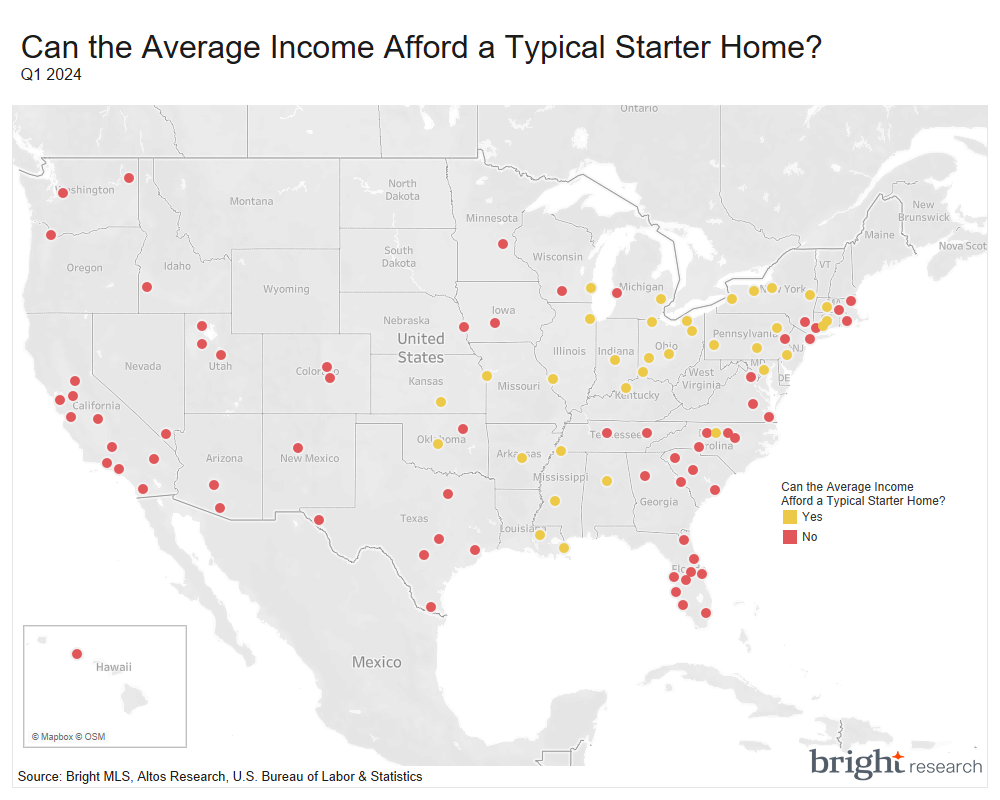

Among the 100 largest metro areas in the U.S., there are just 35 where the average two-worker household has an income (a “starter home” income) high enough to afford the typical starter home. (The typical “starter home” household income is estimated as the income earned by two workers earning 75% of the metro area’s average annual wage.) The best deal for starter homes is the Detroit metro area, where a family needs an income of $34,700 to afford a starter home and the average two-worker starter home salary is $58,300. The other regions where starter homes are affordable are highly concentrated in the Midwest.

Starter homes are least attainable in California metro areas. In the San Jose metro, for example, a family needs an income of $362,600 to afford a starter home. The typical income for a family looking for a starter home is $168,690—less than half of what is needed. Starter homes are also out of reach for prospective first-time buyers in Oxnard, San Diego, Los Angeles, and San Francisco.

But difficulty finding affordable starter homes is not confined to the West Coast. In Madison, Wisconsin, a family needs an income of $133,500 to afford the typical starter home, which is $40,200 more than the typical income earned by prospective starter home buyers. In Charleston, South Carolina; and Nashville, Tennessee; starter homes are unaffordable to two-worker households earning 75% of the region’s average annual wage. In New England, starter homes in both Worcester, Massachusetts; and Providence, Rhode Island; are too expensive for typical starter home buyers. And in the southwest, Tucson, Arizona; and Albuquerque, New Mexico; are two regions where incomes are not high enough to afford the typical starter home.

What is the outlook for starter homes?

Housing affordability reached its lowest level in four decades in 2023 amidst rising home prices and elevated mortgage rates. The average age of the typical first-time buyer has increased as prospective homebuyers are having to wait longer to save for a down payment and find a home in a still-competitive housing market.

Mortgage rates are going to come down in 2024, but rates will still be far above what they were during the pandemic. The inventory of available homes for sale is increasing in many markets, but supply will remain low in 2024 by historic standards. Despite headlines that the recent NAR settlement will bring down housing costs, home prices are being driven by strong demand and limited supply—and those fundamentals are not poised to change significantly this year.

How can it be made easier for first-time buyers to get into a starter home?

- Increase construction of smaller homes. The construction of single-family homes has been increasing, and new homes make up an outsized share of the current housing inventory. Builders can be incentivized to put up new, smaller homes if local zoning regulations allow smaller homes and smaller lots. Large-lot, single-family zoning limits the number of new homes that can be built, which continues to constrain access to housing.

- Get more existing homeowners to list their home for sale. Many homeowners are reluctant to sell if it means trading their super low mortgage rate for a rate that is twice as high. Other homeowners have accrued significant equity in their homes and are hesitant to sell because it would mean getting hit with a big tax bill. Tax and other policies that incentivize homeowners to list their home for sale would free up inventory. President Biden has offered one proposal to provide a tax credit to homeowners who sell to a first-time homebuyer.

Without additional supply, first-time buyers looking for starter homes will continue to feel under pressure in 2024.

.jpg)